Part 31 Contract Cost Principles and Procedures

Content

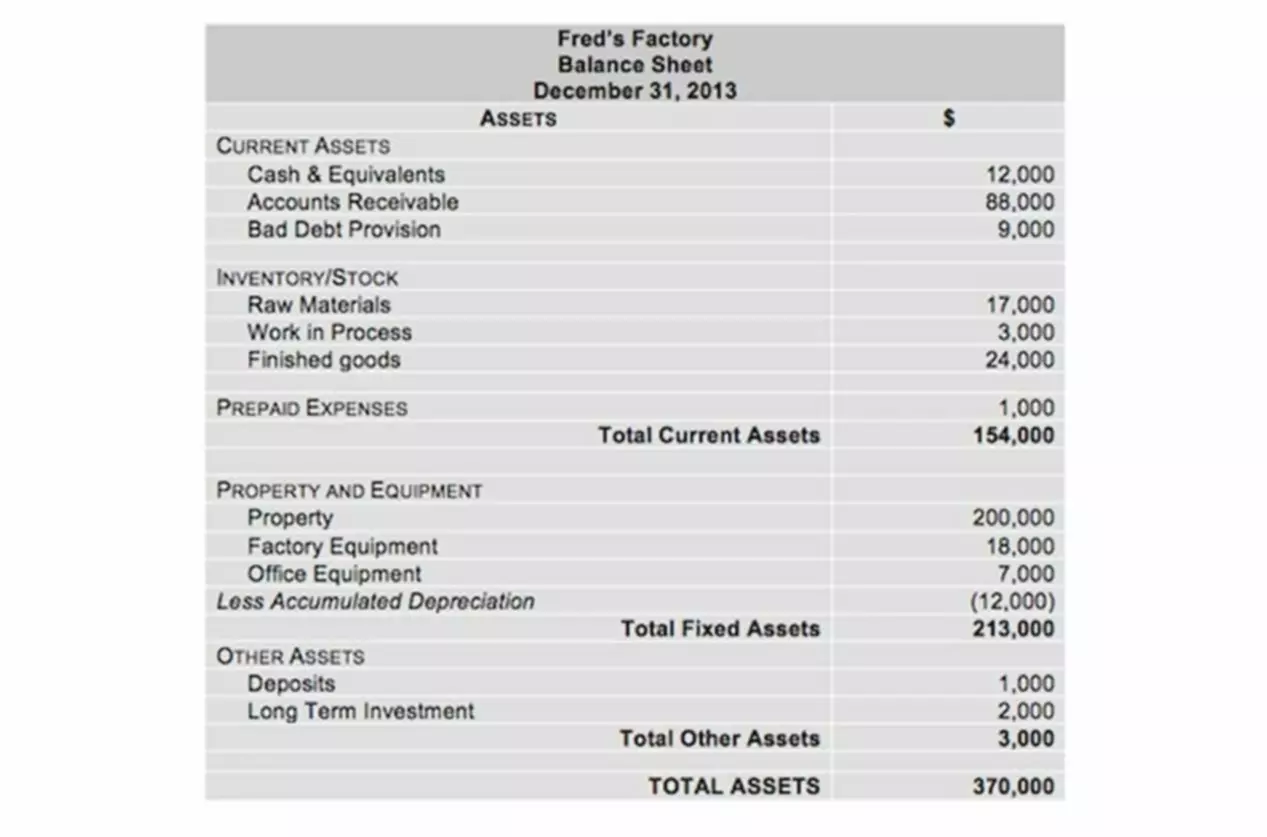

By valuing assets at the price paid when they were acquired, businesses are able to track how the cost to acquire those assets is changing over time, and to make b3udgeting decisions based on historical purchases and long-term trends in price. They can also see how the values of their assets are changing over time, which helps them make decisions about whether to buy equipment new or secondhand based on how the value of that equipment is likely to change in the future. The cost principle is a popular accounting method because it’s simple, straightforward and conservative.

Tangible capital asset means an asset that has physical substance, more than minimal value, and is expected to be held by an enterprise for continued use or possession beyond the current accounting period for the services it yields. Pay-as-you-go cost method means a method of recognizing pension cost only when benefits are paid to retired employees or their beneficiaries. Defined-benefit pension plan means a pension plan in which the benefits to be paid, or the basis for determining such benefits, are established in advance and the contributions are intended to provide the stated benefits. While historical cost loses relevance to market value over time, it is useful precisely because it is not subject to variances in real or perceived market swings. By using historical cost, the balance sheet is not distorted by those variances, comparability is likewise not degraded and accounting information on the whole is solidly reliable.

Historical Cost Principle Definition Explanation and Examples

Subsequent adjustments for currency increases may be allowable only when the non-Federal entity provides the Federal awarding agency with adequate source documentation from a commonly used source in effect at the time the expense was made, and to the extent that sufficient Federal funds are available. (b) Such costs will be equitably apportioned to all activities of the non-Federal entity. Income generated from any of these activities will be credited to the cost thereof unless such income has been irrevocably sent to employee welfare organizations. (a) Costs of contributions and donations, including cash, property, and services, from the non-Federal entity to other entities, are unallowable. (1) For PRHP financed on a pay-as-you-go method, allowable costs will be limited to those representing actual payments to retirees or their beneficiaries.

- For example, under the historical cost principle in IFRS, PPE per IFRS requires to record initially at cost, and the value will be reduced by depreciation or impairment.

- Similarly, if the same company purchased its manufacturing facility and land for $600,000 in 2000, the real estate will remain on its books for the purchase price rather than its current market value of $3 million.

- In all cases, this is likely a result of balancing the need for fair and accurate reporting against the concept of conservatism.

- The excess of the actuarial accrued liability over the actuarial value of the assets of a pension plan is the unfunded actuarial liability.

- (1) Costs which are unallowable under other sections of these principles must not be allowable under this section solely on the basis that they constitute personnel compensation.

(d) When materials are purchased specifically for and are identifiable solely with performance under a contract, the actual purchase cost of those materials should be charged to the contract. If material is issued from stores, any generally recognized method of pricing such material is acceptable if that method is consistently applied and the results are equitable. Applied research does not include efforts whose principal aim is design, development, or test of specific items or services to be considered for sale; these efforts are within the definition of the term "development," defined in this subsection.

Cost Principle Definition in Accounting & Example

Charges for work performed on Federal awards by faculty members during the academic year are allowable at the IBS rate. Except as noted in paragraph (h)(1)(ii) of this section, in no event will charges to Federal awards, irrespective of the basis of computation, exceed the proportionate share of the IBS for that period. IBS is defined as the annual compensation paid by an IHE for an individual's appointment, whether that individual's time is spent on research, instruction, administration, or other activities.

- The assets are recorded at their original cost after accounting for depreciation, if any.

- A cost may be direct with respect to some specific service or function, but indirect with respect to the Federal award or other final cost objective.

- (2) The Federal awarding agency head or delegate must notify OMB of any approved deviations.

- (3) Closing costs, such as brokerage, legal, and appraisal fees, incident to the disposition of the employee's former home.

- Fair value, on the other hand, takes into account how much an asset is worth right now, taking into account factors such as age and wear and tear.

(f) The rental of any property owned by any individuals or entities affiliated with the non-Federal entity, to include commercial or residential real estate, for purposes such as the home office workspace is unallowable. (6) The rental of any property owned by any individuals or entities affiliated with the non-Federal entity, to include commercial bookkeeping for startups or residential real estate, for purposes such as the home office workspace is unallowable. (3) The non-Federal entity and a director, trustee, officer, or key employee of the non-Federal entity or an immediate family member, either directly or through corporations, trusts, or similar arrangements in which they hold a controlling interest.

Learn How NetSuite Can Streamline Your Business

In the 15th century, Italian mathematician Luca Pacioli developed the double-entry bookkeeping system based on the historical cost principle. This system required that every transaction be recorded in two accounts, one representing the asset or expense at its original cost. In the above example, if the cost concept of accounting is followed, the company's balance sheet will always show only the acquisition cost and not the present worth or value of the land. The cost concept of accounting states that all acquisitions of items (e.g., assets or items needed for expending) should be recorded and retained in books at cost.

Depreciation helps you offset the value of an asset over time on your tax return. You decrease the value of the asset in your books throughout the life of the asset. The market value could have changed between the https://www.apzomedia.com/bookkeeping-startups-perfect-way-boost-financial-planning/ initial purchase and when you sell the item. The different values can make it harder to determine your company’s financial health. First, it ensures that financial statements are reliable and consistent over time.