Forex what is nfp?

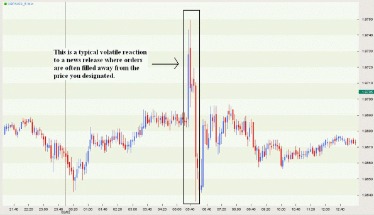

Lastly, utilizing multiple sources of information is crucial for obtaining a well-rounded view of the market. While fundamental analysis offers valuable insights, it also has some limitations. It may not be suitable for short-term traders who focus on quick profits, as it requires a deep understanding of economic principles and global events. Additionally, videforex fundamental analysis does not provide precise timing for trades, as market reactions to news and events can be unpredictable. When the NFP data is released, the forex market experiences high volatility as traders react to the news. If the NFP data is better than expected, the US dollar usually strengthens against other currencies.

- If jobs are strong and the economy is strong, interest rates will likely be rising.

- Prior to the release, economists will attempt to predict what the headline NFP number will be, usually arriving at a consensus estimate.

- “Positive or negative surprises in the NFP report can lead to substantial market movements,” says expert trader Sarah Reynolds.

- By controlling risk with a moderate stop, you are poised to make a potentially large profit from a huge move that almost always occurs each time the NFP report is released.

Two days before that, ADP releases the ADP National Employment Report — a hint for the NFP report. An anticipated shift in the U.S. dollar supply or demand primarily affects the main trading partners of the U.S., like the EU, U.K. The most affected currency pairs would probably be EUR/USD, GBP/USD, USD/JPY, AUD/USD and USD/CHF.

Therefore, policymakers will attempt to boost the economy if the unemployment rate is greater than normal because they believe it to be below its potential. Lower interest rates are part of a stimulative monetary strategy, which also decreases demand for the dollar (money flows out of a low yielding currency). See our post on how interest rates affect FX to see how this works precisely. This involves placing orders above or below the current market price, anticipating a breakout in either direction.

FX: High yielding currencies will start losing their appeal

For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading. It is when the actual result deviates significantly from the forecasted figures that can pre-empt a significant reaction from the market. Before the publication of almost any macroeconomic indicator, including the NFP, forecasts are collected from economists and market analysts. FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and fast, quality execution on every trade.

The BLS reports the nonfarm payroll numbers to the public every month through the closely followed Employment Situation report. While the NFP often influences the market, other major data releases include the CPI (inflation), Fed funds rates, and GDP growth. Forex traders must exercise caution when it comes to data releases such as the NFP.

Advantages of Fundamental Analysis:

The data provided guides them for future actions and earned from the market opportunities. However, traders should be alert to the market signals and use other trade strategies for correct market predictions. Traders should wait for the NFP report and then take any further action to maximise the profits. The currency market is open all day and night and has the ability to trade on the news.

Traders and analysts use indicators such as Gross Domestic Product (GDP), Consumer Price Index (CPI), and the ADP National Employment Report to gauge potential outcomes of the NFP report. We also recommend finding out more about the role of central banks in the forex market, and what central bank interventions involve. Because the NFP data came out worse than expected, we forecast the EUR/USD to appreciate. At FX Leaders, we like to look for 30 pips of upside and risk the same sort of amount to the downside. As you can see, price moved cleanly into the next round number resistance level at 1.0450, giving us a quick and easy profit on the trade.

Therefore, traders of the forex market must analyze and study the NFP report of past and recent for predicting the trade. NFP meaning is quite simple to understand but using it requires good market practice and use. NFP is the report that is released on a monthly basis providing eighty percent of the workforce employed in the U.K. NFP trading has the potential to be profitable, though robust risk management is vital and it is important to understand that things may not always go your way. Those experienced with day trading and news trading are often better suited to NFP trading.

NFP Forex Trading Strategies

These indicators provide valuable statistics on employment, inflation, and economic growth, giving traders a deeper understanding of the factors influencing NFP reports. Another NFP forex trading strategy involves traders assuming that the first market response was accurate. One presumption is that the market's sudden movement following the announcement of the non-farm payrolls signals the beginning of a trend for the following trading day. Currency traders will side with a stronger dollar if the unemployment rate decreases or manufacturing payrolls increase, which is good for the U.S. economy. Investors will turn away from the US dollar in favor of other currencies if the unemployment rate rises and manufacturing jobs decline. When the NFP report shows strong job growth, with higher-than-expected numbers, it is generally seen as a positive sign for the U.S. economy.

NFP data is significant since it is issued each month and serves as a pretty accurate gauge of the status of the economy at the time. The Bureau of Labor Statistics is the source of the statistics, https://traderoom.info/ and an economic calendar lists the date of its upcoming publication. When employment is high and in a good state, policymakers create an expansionary monetary policy with low-interest rates.

Forex News April 12, 2022

The most affected currency pair is GBP/USD; therefore, traders of the currency pair should be careful and use the NFP data/ report for more impactful decisions. It is answered, and how we use or trade with the NFP report is also discussed. But the NFP has a lot in store for the forex traders; it tells about the economy of the U.K., unemployment, and the future of the investments in the forex trade. When the employment rate is down, then the economy works slow, the investments and revenues generated are reduced due to lack of investments and spending. The forex markets have the importance of the interest rates; they play a major part in deciding the future of the market. The rate of interest moves the market, thus an indicator of the fluctuations taking place.

The NFP report is an important economic indicator that affects the forex market. It provides information on the strength of the U.S. labor market and influences the value of the U.S. dollar. Traders closely watch the release of NFP data for trading opportunities, particularly in currency pairs like EUR/USD, GBP/USD, USD/JPY, AUD/USD and USD/CHF. A suggested trading strategy involves waiting for initial volatility to subside, identifying an inside candle pattern and using its high or low as entry points. Fundamental analysis involves the evaluation of various economic indicators, interest rates, political stability, and market sentiment to gain insights into the value of a currency.